TABLE OF CONTENTS

What is surcharge?

A surcharge is a small handling fee that applies only when a customer uses certain payment methods, such as international or business cards. These card types cost more for banks to process, so instead of passing that cost on to the merchant, the fee is applied to the transaction at the point of payment.

Please note, the following information is primarily aimed at merchants based in the UK.

From a merchant’s perspective, charging a surcharge (where permitted) is primarily about fairness, cost control and transparency, not increasing prices. Here are the main reasons merchants choose to apply a surcharge:

- To recover higher payment costs

Some payment methods, such as international or business cards, cost more to process than standard UK consumer cards. A surcharge allows merchants to recover those additional costs rather than absorbing them into their margins. - To keep prices fair for all customers

Without surcharging, higher processing costs are often spread across all customers through higher prices. By applying a surcharge only to eligible payment methods, merchants ensure that customers who choose costlier payment options cover that cost, rather than everyone else. - To protect profit margins

For small and medium-sized businesses in particular, card processing fees can add up quickly. Surcharging helps protect margins, especially on low-value or high-volume transactions, without increasing headline prices. - To offer customers choice and transparency

When clearly communicated, surcharge gives customers a choice:

Pay with a card that has no surcharge

Or proceed with an eligible card, with the surcharge clearly shown before payment

This transparency builds trust and avoids surprises at checkout. - To stay competitive

Instead of raising prices across the board, surcharging allows merchants to keep prices competitive while still managing rising payment costs, especially important in price-sensitive sectors.

In short, surcharging, when used correctly and in line with UK regulations, is a practical tool that helps merchants manage costs fairly, remain competitive, and stay transparent with their customers, without compromising the customer experience.

How does surcharge work?

- A surcharge of 3.89% applies only when an eligible payment method is used. The surcharge is applied exclusively to qualifying transactions and is calculated automatically, then added to the total at the point of payment.

- Not all transactions are subject to a surcharge, only those that meet the eligibility criteria.

- For merchants, this means you are charged 0% on eligible international and business cards, as the surcharge is paid by the customer rather than absorbed by your business.

Example of a surcharge:

A coffee is priced at £5.00.

A customer paying with a UK card pays £5.00.

A customer paying with an international card pays £5.19.

The 19p surcharge (3.89%) reflects the higher processing cost of international cards and is applied automatically at checkout.

Note: In the UK, eligible cards will be all international / business cards.

For the rest of Europe, this applies to cards outside of EU / business cards.

Enabling surcharge for your business

If you’d like to enable surcharge on your Flatpay terminal, simply follow the steps below:

- Contact Flatpay Support: Get in touch with our team info@flatpay.co.uk.

- Eligibility check: We’ll confirm that surcharging is permitted for your country and industry.

- Activation: Once approved, we’ll activate surcharge on your account and notify you as soon as it’s live.

- Test transaction: We recommend running a test transaction on your terminal so you can see how the surcharge is displayed before using it with customers.

- Ensure that your customers are aware of the surcharge. We offer stickers that you can display in your business, and see below for "How can you inform your customers of surcharge?"

What does it cost?

Nothing at all. Surcharge is completely free for all Flatpay merchants.

How does surcharge appear on your payment terminal?

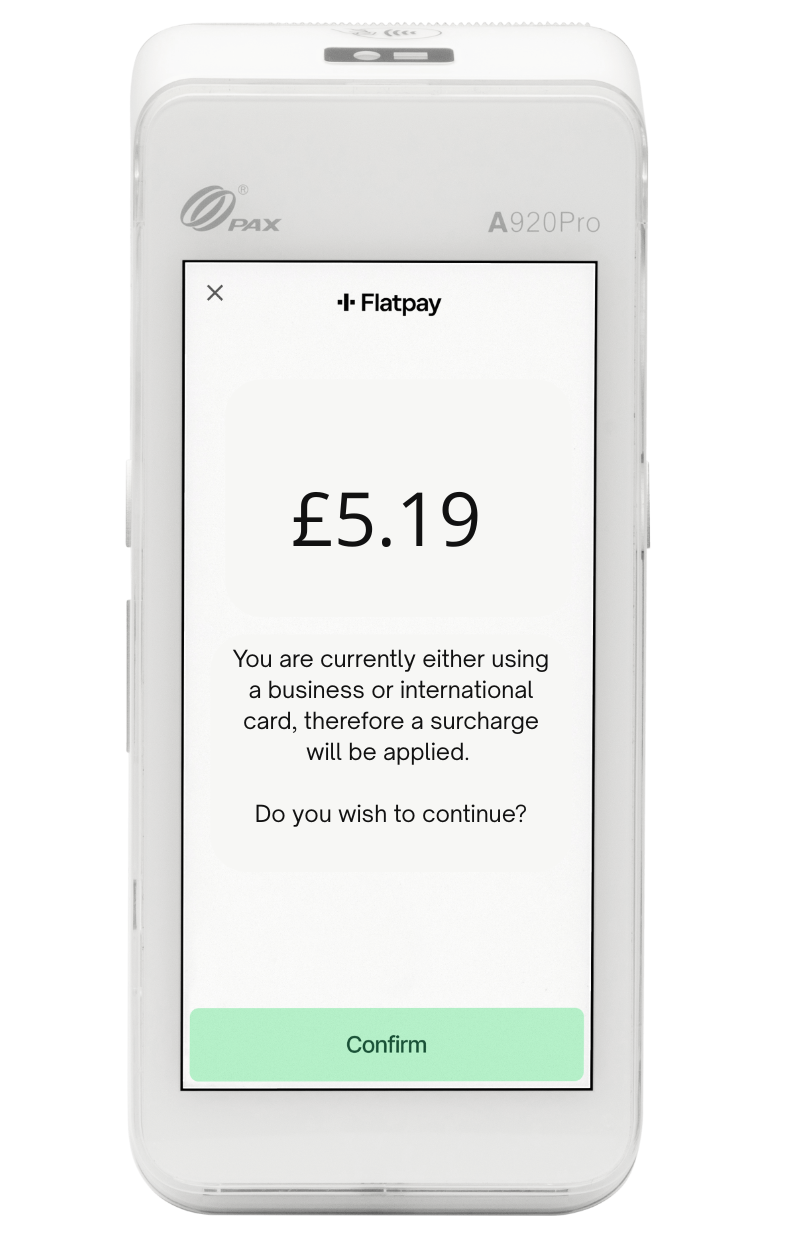

When a customer chooses a card subject to surcharge, the fee is displayed on the terminal screen before payment is confirmed. below is a picture of how this looks on the terminal. The surcharge is also written out on the receipt, so the customer sees the exact amount charged.

How can you inform your customers of surcharge?

Clear and early communication helps build trust and ensures a smooth payment experience. Here’s how and when to explain surcharge to your customers in a simple, transparent way.

When to tell customers

Customers should be informed before they make a payment. This is best done:

- At the point of entry or at the till, using visible signage if possible.

- Before the card is presented or payment is taken, if you can see that the customer is using an international or business card.

- This ensures customers understand any potential surcharge in advance and can choose how they wish to pay.

How to explain it

Keep the explanation short, clear and friendly. For example:

“Some international and business cards incur a small surcharge. This will be shown on the terminal before you complete payment.”

The terminal will automatically display the surcharge amount (if applicable) before the transaction is finalised, giving customers full visibility and control.

How to stay transparent

- Ensure staff are aware of when surcharge applies and can explain it confidently

- Reassure customers that not all cards are surcharged, only eligible payment methods

- Display Flatpay surcharge stickers clearly in your store window or near terminals if you wish

Why this matters

Being upfront about surcharge helps you stay compliant with regulations in your country, and avoids surprises at checkout, and reinforces a fair, open relationship with your customers.

In short: tell customers early, explain it simply, and let the terminal do the rest.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article